HST Registration - YES or NO

HST Registration for small businesses and start ups - YES or NO

We often get asked in my accounting seminars - I don’t expect to have more than $30,000 revenue in the first year - should I get an HST number?

We always answer yes - with conditions - though I’m aware that some accountants and consultants suggest it’s not necessary. The only times it may not be advisable, is a situation where you only bill your labour and never purchase anything, or you’re illegally avoiding paying tax.

My answer is based on the premise that you’re doing basic accounting and bookkeeping and using a computer or program and as a result the administrative task of filing returns is quite simple and straightforward.

Reason number 1 is that it makes you look more professional.

Reason number 2 is that if you’re successful - and we expect you to be - that you’ll need to do it sooner than later anyway and face the process of changing internal systems and “changing client attitudes”.

Reason number 3 is most significant and it’s about money! All small businesses need to optimize their expenses and take advantage of all tax breaks. We’ll do two scenarios as examples of why you’re better off financially to register. Everyone likes to save money!

Small Business ONE - Susans Seamstress Services

Susan is a proprietorship, and she’s rented some space in her small town on the front street, she needed some equipment and supplies to start up, some signage, a cash register, a computer some furniture and other little things. She was only open half days at first.

Golly by the time she was finished she’d spent almost $20,000. And guess what - she paid HST on almost everything she bought. Let’s look at her first 6 months both ways.

SEE Case 1 for a spreadsheet on Susans Business numbers:

Now of course this a start up - you net out spending more and get a refund cheque - what about ongoing business. People say “but I’m sending the government money every six months - or even more often”. Yes, that’s true, but (and this is where folks get confused) the money you’re sending the government isn’t yours - it’s your customers money. You get to KEEP all the money you spent on HST from the HST your customers pay you - and you get back (your expenses are LOWER) the amount of HST you paid on stuff. Remember you’re paying HST on almost every expense even in a small business. You need to remember you get to claim all your SPENT HST against all the HST you collect from your customers.

So even if you’re a part timer billing less than $30,000 a year, if you look closely, you probably have expenses of $5,000 or more likely $10,000 per year. The HST on $10,000 is $1,300 - not really “chump change”.

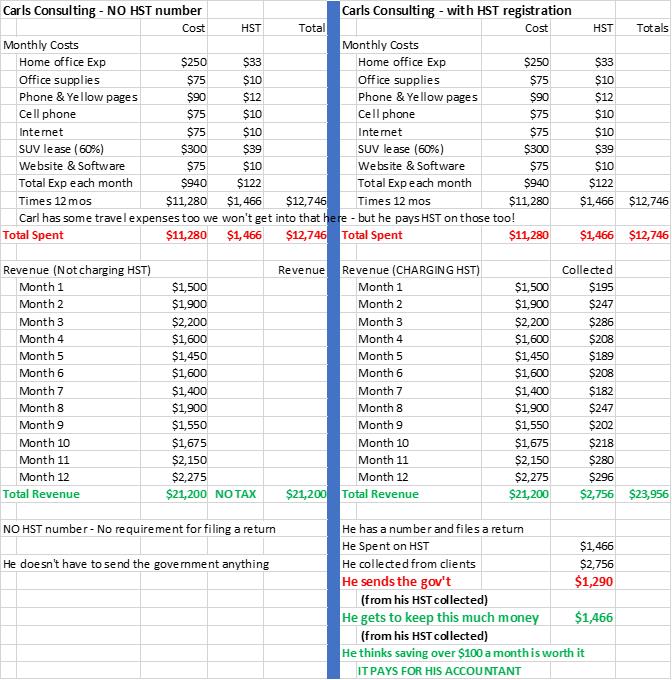

Case 2 on PAGE 3 is Carls Consulting, maybe Carl is a retired person or a person with another job. He bills between $20,000 and $25,000 each year. One might immediately think “oh; he doesn’t buy stuff - he just sends clients an invoice”. Does he?

Carl needs to drive to lots of client meetings, so he has a nice SUV which he also uses personally. He needs good internet, a top notch cell phone package, and a nice home office with a rather expensive printer and computer and some industry specific software, and he goes to 2 or 3 conferences a year. He also takes his clients out for dinner from time to time.

Case 1 Susans Seamstress Services

We often get asked in my accounting seminars - I don’t expect to have more than $30,000 revenue in the first year - should I get an HST number?

We always answer yes - with conditions - though I’m aware that some accountants and consultants suggest it’s not necessary. The only times it may not be advisable, is a situation where you only bill your labour and never purchase anything, or you’re illegally avoiding paying tax.

My answer is based on the premise that you’re doing basic accounting and bookkeeping and using a computer or program and as a result the administrative task of filing returns is quite simple and straightforward.

Reason number 1 is that it makes you look more professional.

Reason number 2 is that if you’re successful - and we expect you to be - that you’ll need to do it sooner than later anyway and face the process of changing internal systems and “changing client attitudes”.

Reason number 3 is most significant and it’s about money! All small businesses need to optimize their expenses and take advantage of all tax breaks. We’ll do two scenarios as examples of why you’re better off financially to register. Everyone likes to save money!

Small Business ONE - Susans Seamstress Services

Susan is a proprietorship, and she’s rented some space in her small town on the front street, she needed some equipment and supplies to start up, some signage, a cash register, a computer some furniture and other little things. She was only open half days at first.

Golly by the time she was finished she’d spent almost $20,000. And guess what - she paid HST on almost everything she bought. Let’s look at her first 6 months both ways.

SEE Case 1 for a spreadsheet on Susans Business numbers:

Now of course this a start up - you net out spending more and get a refund cheque - what about ongoing business. People say “but I’m sending the government money every six months - or even more often”. Yes, that’s true, but (and this is where folks get confused) the money you’re sending the government isn’t yours - it’s your customers money. You get to KEEP all the money you spent on HST from the HST your customers pay you - and you get back (your expenses are LOWER) the amount of HST you paid on stuff. Remember you’re paying HST on almost every expense even in a small business. You need to remember you get to claim all your SPENT HST against all the HST you collect from your customers.

So even if you’re a part timer billing less than $30,000 a year, if you look closely, you probably have expenses of $5,000 or more likely $10,000 per year. The HST on $10,000 is $1,300 - not really “chump change”.

Case 2 on PAGE 3 is Carls Consulting, maybe Carl is a retired person or a person with another job. He bills between $20,000 and $25,000 each year. One might immediately think “oh; he doesn’t buy stuff - he just sends clients an invoice”. Does he?

Carl needs to drive to lots of client meetings, so he has a nice SUV which he also uses personally. He needs good internet, a top notch cell phone package, and a nice home office with a rather expensive printer and computer and some industry specific software, and he goes to 2 or 3 conferences a year. He also takes his clients out for dinner from time to time.

Case 1 Susans Seamstress Services

Case 2 Carls Consulting Services

As you can see from these models, it’s hard to make a case for NOT registering to collect HST! Even if you only spend $5,000 each year on business expenses - the HST is $650 - and it’s year after year after year.

Good Luck!

Good Luck!